RiaFin Alternatives

Searching for an alternative to a financial platform usually brings up a fundamental question: Are you trying to replace a piece of software, or are you looking for a different financial philosophy?

Most "alternatives" pages offer a standard feature-by-feature comparison chart. They pit one platform against [Generic Fintech App] to see who has the better expense tracker, the cheaper subscription tier, or the slicker dashboard animations.

"We aren't going to do that. Because comparing a rigorous financial education to a piece of software is a category error."

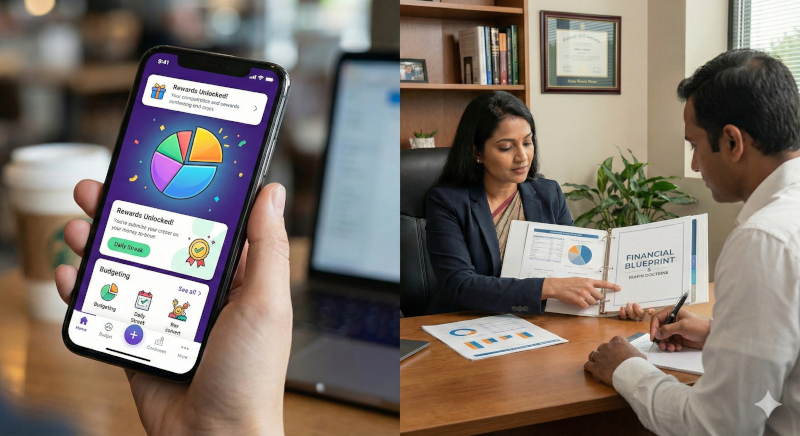

If you are looking for a digital toy to "track" your spending or a gamified app to give you "rewards" for buying insurance, go to the App Store. Download any of the thousand "wealth" tools available. They are all essentially the same: lines of code designed to keep you clicking, not to make you wealthy.

RiaFin is not an app. It is not a software. It is an empowering educational marketplace. We give you the philosophy, and then we give you the bridge to the human advisors who can execute it.

The difference between a digital distraction and a dedicated fiduciary relationship.

Code is Cheap. Education is Power.

The fintech industry wants you to believe that wealth is a software problem. They give you calculators, "bite-sized" reels, and slick dashboards.

Those are distractions.

A piece of code cannot teach you the difference between a salesman and a fiduciary. Software cannot hold you accountable when you’re tempted to take on "smart leverage" for a depreciating asset. Code doesn't care if you retire; it only cares if you stay logged in.

At RiaFin, we don't just build apps; we build grounded, resolute clients.

The RiaFin Doctrine: Your Framework for Financial Sovereignty

We don't hire advisors, and we don't force them to believe what we believe. Instead, we arm YOU with the RiaFin Doctrine. We teach you an uncompromising financial philosophy so that when you enter our marketplace, you know exactly who to hire and—more importantly—who to fire.

The Principles We Empower You to Demand:

- 1. Fiduciary is the Only Standard We teach you that if an advisor earns a single paisa in commission from the products they recommend, they aren't an advisor—they are a salesman. You learn to demand the 100% Fee-Only Fiduciary standard for your wealth building.

- 2. The Income Engine Your wealth isn't built by "picking the right fund." It’s built by your active income. We teach you to focus on maximizing your career or business output to fuel your freedom, rather than gambling on market volatility.

- 3. Debt is a Shackle The industry loves to sell you "good debt." We call that mathematical idiocy. We teach you to stop "managing" debt and start eliminating it with resolute intensity.

- 4. Simplicity is Safety Complexity is the mask commission-hungry banks use to hide their fees. We teach you that if you can’t explain your strategy to a 10-year-old, you’re being misled.

The Path: The 8 Steps RiaFin Framework

Our doctrine provides you with the 8 Steps Framework—a disciplined framework designed for the Indian economic reality. Whether it’s securing your Starter Shield (independent insurance), completing the Detox (the Debt Snowball), or establishing your Legal Safe (a Registered Will), this is the blueprint you take to the advisors in our marketplace.

The Marketplace Reality: 12 Types of advisors

The financial world is complex, and "one-size-fits-all" is a lie. RiaFin is a matchmaking marketplace that provides absolute transparency across 12 distinct types of advisors.

From SEBI RIAs and FPSB CFPs (the fiduciaries we champion for wealth building) to Debt Specialists, Chartered Accountants, and even Insurance Agents.

We don't hide the commission-based advisors; we put a spotlight on them. We categorize every listing by how they are compensated—Fee-Only, AUM-based, or Commission-based—so that for the first time, you have the total power to choose exactly the kind of relationship you want.

Explore our Helpsite at help.riafin.com/users/getting-started to learn how to choose the right advisor and understand exact fee models.

The "Unfair Advantage" Comparison

| The Standard | The RiaFin Reality 👍 | The App Store Illusion 👎 |

|---|---|---|

| Financial Education | Rigorous RiaFin Doctrine | "Bite-sized" Reels & Notifications |

| Advisor Access | 12 Distinct Types of Human Pros | Automated Bots / Hidden Salesmen |

| Fee Transparency | Absolute Clarity (Fee vs. Commission) | Hidden in the Spread & Fine Print |

| The Framework | The 8 Steps Framework | "Customized" (Random) Suggestions |

| Your Role | Educated Commander | Passive User |

Why the Top 5% of Advisors List with Us

The most elite SEBI RIAs and CFPs in India don't want to compete with chatbots or "lead-gen" scripts. They list on the RiaFin marketplace because they want to work with clients who have graduated from "budgeting apps" and are armed with a grounded strategy.

We are the filter. We ensure that the most serious clients meet the most transparent financial advisors.

The Final Verdict

Algorithms don't build wealth; they just track your position. If you want to keep "managing" your money with a digital toy, there are plenty of "alternatives" out there.

But if you want to be armed with an uncompromising financial education and the transparent access to choose the exact human expert you need, there is no substitute for the RiaFin standard.

Stop clicking. Start commanding.

Take the Free 2-Minute Matching QuestionnaireFind the financial advisor who fits your framework.