Find Fiduciary Financial Advisors in India

Discover SEBI-registered investment advisors, FPSB-certified financial planners, and other vetted fiduciary professionals across India for comprehensive goal-based financial planning services—retirement, tax, NRI, wealth, or education.

What We Do Not Do:

- • We do not provide financial advice

- • We do not recommend or rank advisors

- • We do not sell financial products

the value of a great financial adviser

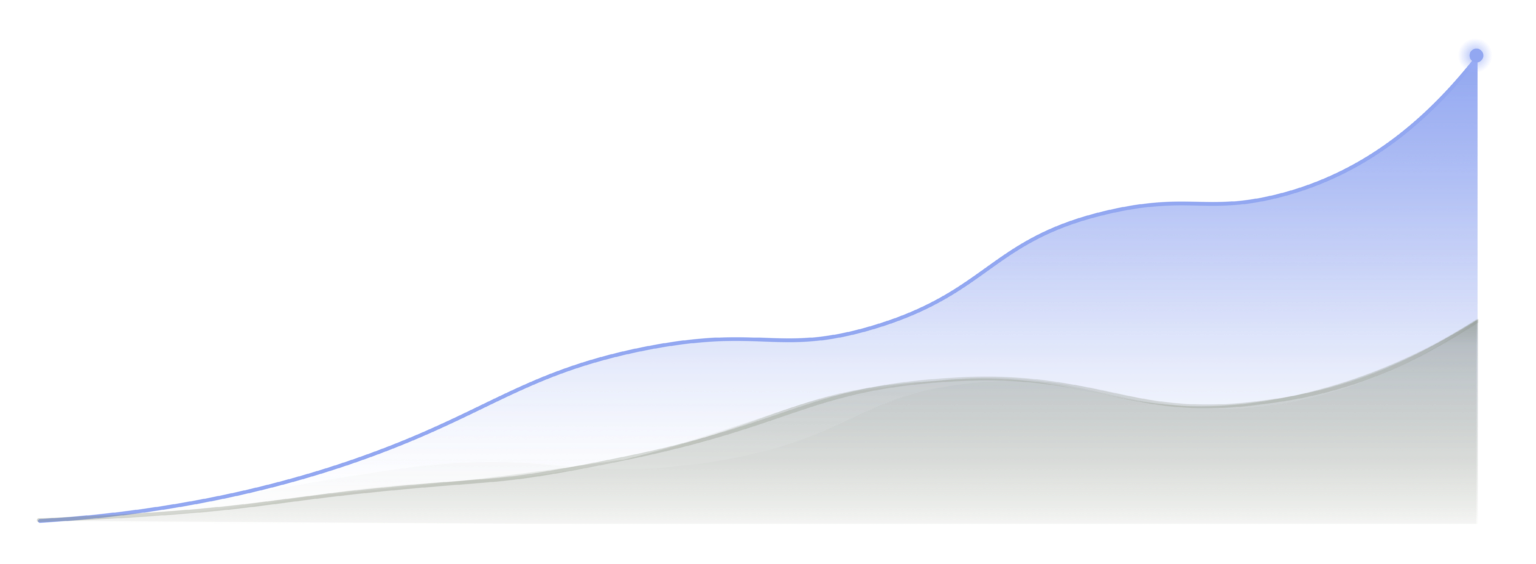

Collaborating with a certified fiduciary financial adviser can contribute up to an additional 3% to your annual returns [1].

With an Adviser

₹ 3,424,237/-

Without an Adviser

₹ 1,693,177/-

** 25-Year Investment.

[1] Assuming 5% annualized growth of ₹500,000/- portfolio vs 8% annualized growth of financial adviser managed portfolio over 25 years. Source: Vanguard Australia, "Advice improves more than just returns."

Unlock Your Portfolio's Full Potential with Fiduciary Financial Advisors

The projected 3% growth advantage comes from expert, conflict-free alignment. Stop leaving returns on the table and start your journey with vetted SEBI-registered Investment Advisers (RIAs) and FPSB-Certified Financial Planners (CFPs) across India who work solely for your financial success, not for commissions.

Understanding Financial Advisors

Make informed decisions by understanding the different types of advisors and certifications available.

What is a Fiduciary?

A fiduciary is a financial advisor legally obligated to act in your best interest at all times. Unlike sales-driven advisors who may push products with commissions, fiduciaries provide unbiased, conflict-free advice. They must disclose all conflicts of interest and prioritize your financial well-being above their own profits. For investment advisory and goal-based financial planning—retirement, tax, NRI, wealth, or education—working with a fiduciary ensures recommendations are genuinely aligned with your objectives, not sales targets.

Fee Structures Explained

Fee-Only Advisors charge a flat fee or hourly rate and earn no commissions—eliminating conflicts of interest. Fee-Based Advisors may charge both fees AND earn commissions on products they sell, creating potential conflicts. AUM-Based Advisors charge a percentage of assets under management (typically 0.5-2%), which can incentivize keeping assets invested even when it might not be optimal. At RiaFin, we prioritize fiduciaries to ensure objective, client-centered advice.

Key Certifications

SEBI RIA (Registered Investment Adviser) is a regulatory certification from India's market regulator, requiring advisors to meet strict compliance, disclosure, and fiduciary standards. FPSB CFP (Certified Financial Planner) is a professional designation demonstrating expertise in comprehensive financial planning, investments, insurance, tax, and retirement planning. While SEBI RIA focuses on regulatory compliance, FPSB CFP validates technical planning skills. The best advisors often hold both—bringing together regulatory trust with planning expertise.

Why Choose RiaFin?

RiaFin connects you exclusively with vetted fiduciary financial advisors who undergo our rigorous 6-point due diligence process. Our intelligent matching algorithm analyzes your age, goals, location, and financial situation to pair you with 1-3 advisors perfectly suited for your needs. We don't sell financial products, don't accept commissions, and don't rank or endorse advisors—we simply empower you to make informed decisions. Start your journey to comprehensive financial planning with confidence today.

The Highest Standard of Trust

Our due diligence process only approves the best of fiduciary financial advisors. This implies that you exclusively collaborate with the very best in the field.

Credentials and Education

We categorize fiduciary financial advisors based on their qualifications. Only those possessing one or more necessary designations (CFP®, CFA®, CA, SEBI RIA, etc.) proceed to the next stage.

Experience

Experience cultivates knowledge. We guarantee that every fiduciary financial advisor on the RiaFin platform possesses enough years of pertinent experience.

Unbiased and Transparent

Fiduciary financial advisors on the RiaFin platform must act in your best interest. Only those who remain impartial and refrain from overcharging their clients proceed to the next stage.

Investment Process

Fiduciary financial advisors are then evaluated on their subject-matter expertise, accountability, financial and investment processes, and operational efficiency.

Financial Planning Skills

We conduct interviews with fiduciary financial advisors to assess their technical, communication and interpersonal skills, along with the overall client experience they provide.

Client Communication

We evaluate how advisors communicate with clients, ensuring they provide clear explanations, timely responses, and maintain ongoing relationships that prioritize client understanding and satisfaction.

How It Works

Get matched with vetted fiduciary advisors in three simple steps

Answer a Few Questions and Get Matched

Take our 2-minute questionnaire to assess your top fiduciary financial advisor matches.

Smart Matching: Our algorithm carefully matches you with 1-3 fiduciary financial advisors and planners tailored to your specific situation.

Your Adviser Matches

Srivari Aggarwal - CFA, CFP

Mumbai, Maharashtra

Tony Pinto - SEBI RIA

Porvorim, Goa

P Muthuswamy Iyenger - SEBI RIA, CFP

Chennai, Tamil Nadu

* The information above is for illustrative purposes only.

Your Adviser Matches

Srivari Aggarwal - CFA, CFP

Mumbai, Maharashtra

Tony Pinto - SEBI RIA

Porvorim, Goa

P Muthuswamy Iyenger - SEBI RIA, CFP

Chennai, Tamil Nadu

* The information above is for illustrative purposes only.

Answer a Few Questions and Get Matched

Take our 2-minute questionnaire to assess your top fiduciary financial advisor matches.

Smart Matching: Our algorithm carefully matches you with 1-3 fiduciary financial advisors and planners tailored to your specific situation.

Schedule a Complimentary Call and Have a Conversation

Connect with your fiduciary financial advisor matches and discover the ideal advisor for you.

Interview Process: Interview the thoroughly vetted fiduciary financial advisors to determine the best fit for your needs.

Srivari Aggarwal - CFA, CFP

Mumbai, Maharashtra

Schedule a FREE Introductory Call

* The information above is for illustrative purposes only.

Schedule a Complimentary Call and Have a Conversation

Connect with your fiduciary financial advisor matches and discover the ideal advisor for you.

Interview Process: Interview the thoroughly vetted fiduciary financial advisors to determine the best fit for your needs.

Srivari Aggarwal - CFA, CFP

Mumbai, Maharashtra

Schedule a FREE Introductory Call

* The information above is for illustrative purposes only.

Start Your Growth and Grow Your Wealth

Establish a financial relationship and build trust with a reliable fiduciary financial advisory expert who works for you.

Long-Term Partnership: Safeguard your financial future with an advisor committed to your success.

Your Financial Future

Your Financial Future

Start Your Growth and Grow Your Wealth

Establish a financial relationship and build trust with a reliable fiduciary financial advisory expert who works for you.

Long-Term Partnership: Safeguard your financial future with an advisor committed to your success.

Takes less than 2 minutes · AI-Powered Matching · FREE Matching

Frequently Asked Questions

Everything you need to know about using RiaFin to find your ideal financial advisor

Q: Is RiaFin's matching service really free?

Yes, completely free. RiaFin does not charge clients any fees for using our matching service. You can complete the 2-mins questionnaire, receive advisor matches, schedule introductory calls, and interview advisors at no cost. We do not accept commissions from advisors or financial product providers.

Q: How many advisors will I be matched with?

Our intelligent matching algorithm typically pairs you with 1-3 fiduciary financial advisors based on your specific needs, goals, location, and financial situation. This curated approach ensures quality matches rather than overwhelming you with options.

Q: How long does the matching process take?

The questionnaire takes less than 2 minutes to complete. Once submitted, you'll typically receive your advisor matches within 5-10 minutes. You can then schedule complimentary introductory calls with matched advisors at your convenience.

Q: Does RiaFin recommend or rank specific advisors?

No. RiaFin does not recommend, rank, or endorse specific advisors. We provide you matches with vetted advisors based on your profile, but the final selection is entirely yours. We empower you with information to make informed decisions independently.

Q: What happens during the complimentary introductory call?

The free introductory call (typically 15-30 minutes) upon your own discretion lets you discuss your financial goals, ask about the advisor's approach and experience, understand their fee structure, and assess if there's a good fit. This is a no-obligation conversation to help you evaluate potential advisors.

Q: Can I get matched with advisors outside my city?

Yes. While our algorithm considers location preferences, we offer flexible engagement models to suit your needs. In our quick 2-minutes questionnaire, you can explicitly select your preference — Location, Remote, or Overseas NRI — ensuring you are matched with qualified professionals aligned with your specific profile.

Q: What if I'm not satisfied with my matches?

You can browse our advisor directory to find professionals that better suit your needs. Our platform is designed to give you flexibility and control throughout the selection process.

Q: Do I need a minimum investment amount to use RiaFin?

No. RiaFin's matching service has no minimum investment requirement. However, individual advisors may have their own minimum asset or fee thresholds, which will be disclosed during your introductory conversations with them.

Q: How does RiaFin ensure advisor quality?

Every advisor undergoes our rigorous 6-point due diligence process evaluating credentials, experience, transparency, investment methodology, financial planning skills, and client communication. We maintain a strict acceptance rate of less than 5%, ensuring only top-tier fiduciary financial professionals join our platform.

Q: Am I obligated to hire an advisor I'm matched with?

Absolutely not. There is no obligation to engage with any advisor you're matched with. RiaFin provides the connection and vetting, but you retain complete control over whether, when, and with whom you choose to work.

Find, Hire, and Invest with Vetted, Fiduciary Financial Advisors in India

Every advisor on our platform undergoes a rigorous vetting process evaluating credentials, experience, transparency, investment methodology, financial planning expertise, and client communication skills. We only accept fiduciary professionals who meet our strict standards, ensuring you connect with the very best financial advisors for your needs.

No credit card required · Free matching · Unbiased recommendations

Featured Insights

Discover our handpicked articles on financial planning, investment strategies, and wealth management.

Best financial advisors for retirement planning in india

Looking for the best financial advisor for retirement planning in India? Learn how to find a fiduciary retirement planner you can trust, what to expect, and how to choose the right expert for your future.

10 essential questions to ask a fiduciary financial advisor during your free intro call

Prepare for a successful financial advisory intro call with this checklist of 10 essential questions tailored to retirement, tax, insurance, and investment needs—plus a simple script to get the most out of your 15–20 minute session.

Debt management made simple: proven strategies to get out of debt and rebuild financial freedom

Learn how to manage debt the smart way using proven strategies like the avalanche method, snowball method, consolidation, budgeting, and disciplined repayment. A complete beginner-friendly guide to achieving financial freedom.

Financial planning explained: benefits, best options, tools & how to build your own plan step-by-step

Learn how financial planning really works, why you need it, how to choose the right options, and which tools help you build a secure financial future. A clear, beginner-friendly explainer that helps you take control of your money with confidence.

Latest Articles

Stay updated with our most recent financial tips, guides, and expert advice.

Why buying direct mutual funds in india beats distributors

Find out why investing in direct mutual funds in India helps you save on expense ratios, avoid commission bias, compound faster, and gain full folio ownership. Learn where and how to invest directly, when distributors make sense, and see real-life SIP and lump sum scenarios.

Realistic 1 crore retirement plan with nps: contribution scenarios, returns & risks explained

Discover how to build an NPS retirement corpus of ₹1 crore with realistic return assumptions, calculators, contribution strategies, and key NPS risk factors. Learn how much to invest in NPS to reach 1 crore and how to mitigate market, inflation, and tax risks.

Nps vs ppf vs elss vs vpf: which tax-saving investment is best for you in india (2026 guide)

Compare NPS vs PPF vs ELSS vs VPF to find the best tax-saving instrument for Indian salaried professionals under old and new income tax regimes. Explore returns, risks, lock-in, liquidity, and Section 80C/80CCD benefits.

Misleading financial advice in india: how mutual fund distributors create investor confusion

Learn how mutual fund distributors in India create confusion by posing as financial advisors. Understand SEBI rules, risks, and how to protect your investments.